We have had some clients come to us, desperate to leave their current copier situation. They have a lease they are completely upside down in and want to know what they can do to improve their situation. I want to address the question –

“What can we do if we want to get out of our copier lease?”

The problem you face when trying to get out of a copier lease is the items are essentially being financed by a bank and maintained, in general, by a local company. In a lot of ways this is like leasing a vehicle and getting an extended warranty through a local dealer.

The first thing to consider is the situation everyone is in. It will help you understand why you may be having trouble getting what you want, and why everyone feels a bit helpless in the situation.

The Bank:

A key player in the copier lease is the bank. The bank is the company who finances the copier so you can use it for the next five years. The part that is confusing to most people is even the manufacturer’s financing is not always owned by that manufacturer.

So, the bank is loaning money, expecting a return oon their investment and if you return the copier early without paying, for them all that is lost revenue and lost profit. If they let every frustrated user out of their copier lease, the current rates of 8 percent would go up to 20% or 30% interest. Part of the stubbornness is to ensure other clients can get competitive rates.

The Dealer:

The next entity you ,may try and get relief from is the dealer that sold you the copier. You are thinking, perhaps, this dealer I paid $10,000 to over the last 3 years, so it is their job. This is where you hit another hiccup. The dealer may have charged you $10,000, but if they charged that amount, they certainly didn’t make that amount. Most dealers run on about 15% margin, so this means of the $10,000 you paid, they made $1,500 and then sent the $8,500 to the manufacturer.

The dealer isn’t making a ton on your copier, and if they simply “let you out of the deal,” first they would have to pay the bank back (with interest) AND they would be stuck with the copier they probably ordered for you. They have no control over the production quality of the copier, so they generally will do all they can to make sure they are working, but generally will not feel responsible for a recurring issue with the copier since they didn’t make it.

The Manufacturer:

Next we get to the manufacturers. They are almost always, many multiple billion dollar entities who are trying to move a ton of boxes. They, in general train the field reps on the copiers, so they also do not always feel compelled to help. They will assume the servicing dealer is making a mistake and often by the time the manufacturer is involved, the situation is so dirty it is unrecoverable.

The Customer (You):

So here you are, you have a copier that is broken that the bank won’t let you out of because they simply loaned you money to have it, the dealer won’t accept a return because they have already invested a ton of hours to fix the issue and they only made 15% of what you spent. The manufacturer won’t help because they are saddled with multi-billion dollar logic and policies to protect the bottom line. Your copier is broken and everyone is pointing at someone else.

A maddening position many find themselves in.

Normal Resolution:

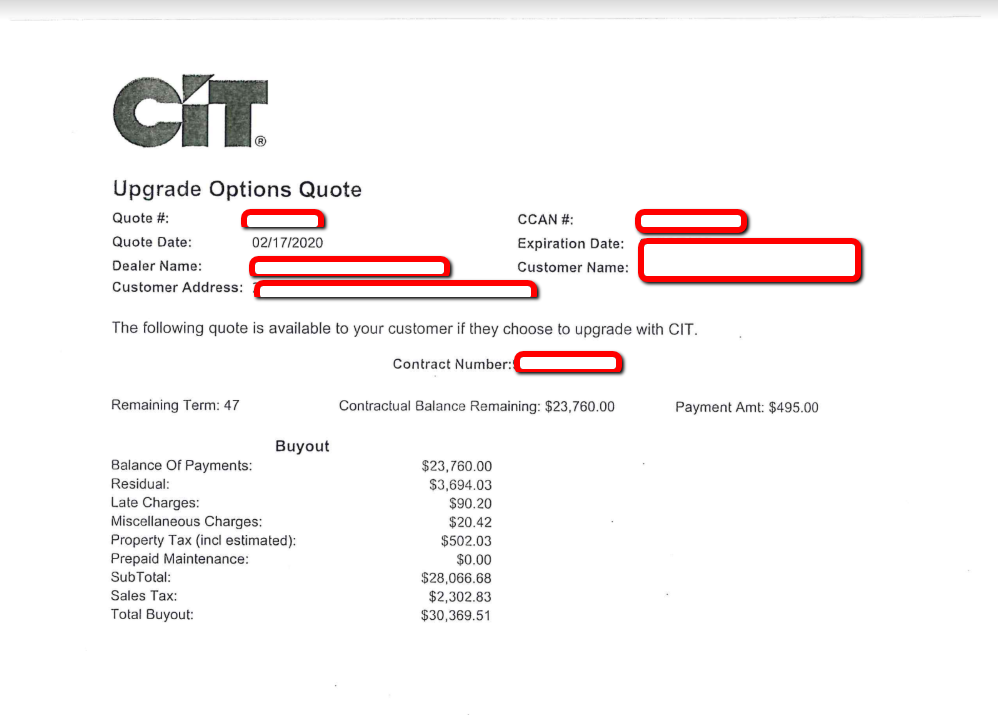

Most companies in this position, get the buyout numbers from the bank and then roll that payment into the next lease. But what if your situation is REALLY messy. For example, we are working with a client who has a huge mess on their hands. They have a copier that isn’t meeting their needs and is costing them an arm and both legs.

The problem this client has is they signed up for a lease that was WAY too expensive and the bank is simply trying to make sure they don’t lose money when they give the buyout. To be clear, in this scenario, we cannot see where the bank had any part of the frustrations. The bank simply financed what the client and their dealer agreed to.

The dealer probably had to pay about $20,000 for the equipment, and it says there are 47 months to go. If the dealer were to take back the copier, they will have lost basically $20,000 – You would expect the number to be lower, but remember the bank adds interest. The client is asking the copier lease company to take back a 13 month old copier for the same price as a brand new copier and most clients will even say they are so unsatisfied there is no way they will keep working with the dealer.

As the owner of the copier company, what would you do? You have a copier that a client wants to return at the full rate, but it is a 13 month old copier. You may have cash flow troubles which makes $20,000 to be a bit too much. Maybe you are unable, even if you wanted to work with the client.

So does that mean the client should be stuck with the copier lease? All of these questions are hard to answer. We just wanted to help you understand why getting out of a copier lease may be harder than you expected.

The copier company you are working with will generally reach out to their manufacturer. Most good manufacturers will help. Maybe they will help with client training, maybe they will swap. Then generally understand the wisdom of making sure the enduser client is happy. Xerox had a program, for instance, they called the Total Satisfaction Guarantee which they have done away with, but with enough pushing you can normally get something done for the client.

When dealing with a situation where the copier is driving you nuts… our first step is to try your best to work with your dealer. Often because of their manufacturer relationship they can get things done for you. If you start the conversation as a war, often they are reduced to feeling like they cannot really make you happy and may not work as hard to solve the problem, but will start spouting the rules to you rather than looking for a cooperative solution to create a win/win for everyone. Of course, even if you do your side perfectly, it may not get you where you are trying to go.

If you feel we can help you out with a copier lease or helping you understand your current copier lease, we are here for you!

NEED A QUOTE NOW?

You'll Get a Real Quote in Under 2 Minutes!